An expert committee called the Garg Panel – set up to examine the legality and viability of Blockchain and Cryptocurrency has recommended in its report submitted to the Finance Ministry in the Government of India that private Cryptocurrencies be completely banned in India and has drafted a law that mandates a fine of up to Rs 25 crores and imprisonment of up 10 years for anyone deals with them.

The panel has, however, also recommended the introduction of a single cryptocurrency for the country—that is backed by the Reserve Bank of India. So, while Cryptocurrency continues to make news with its volatility–banning it has only resulted in the asset going underground and becoming hard to track.

In all this noise–what seems to have got less attention is the fact that the same panel seems to be positively inclined towards Blockchain Technology and has called for introducing an RBI backed cryptocurrency based on Blockchain.

But first, let’s define the difference between Blockchain and Cryptocurrency and understand the connection between the two. How did Blockchain come about?

Our global financial system is a colossal unwieldy behemoth full of challenges–moving huge amounts of funds via millions of transactions to almost every living being on this planet–hampered by fees, rules, errors, delays and a breeding ground for fraud and crime. The costs of running this gigantic infrastructure are passed on to unhappy customers.

The inefficiency of our highly centralized and vulnerable financial system based on antiquated processes with a digital exterior layer has led to the creation of an innovative system that addresses all these challenges and more. It’s called a blockchain.

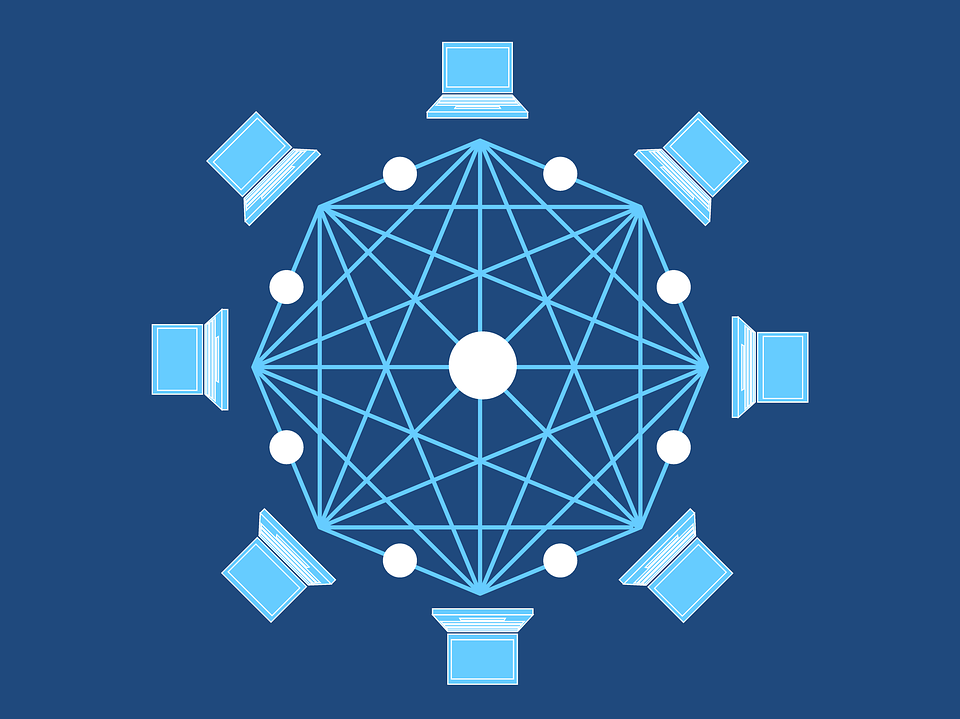

In their seminal piece in the Harvard Business Review, Alex Tapscott and Daniel Tapscott have defined Blockchain as a “huge globally distributed ledger running on millions of devices, capable of recording anything of value.

Money, equities, bonds, titles, deeds, contracts, and virtually all other kinds of assets can be moved and stored securely, privately, and from peer-to-peer, because trust is established not by powerful intermediaries like banks and governments, but by network consensus, cryptography, collaboration, and clever code.

It is now possible for two or more parties, be they businesses or individuals who may not even know each other, to exchange agreements, make transactions and create value without relying on intermediaries, between themselves.

For instance, if a group of people has access to this ledger, they all, uniformly, will know the exact financial annotations and will track any changes made by any member–after a change in any one copy of the blockchain ledger–because it will reflect in all copies, including the main one and make transaction tracking straightforward and transparent.

A cryptocurrency is a peer-to-peer internet-based currency that uses a block-chain to store the transactions in a public ledger. The transactions are secured using cryptography. Cryptocurrency has high mining value and has made several crypto enthusiasts rich by their understanding of this virtual currency.

It’s simple–Blockchain is a technology and Cryptocurrency is an application of that technology. Cryptocurrency is the world’s first and most successful application (use case) of blockchain technology. They build cryptocurrencies such as Bitcoin on top of the blockchain. The blockchain is independent of Cryptocurrencies.

There is now a deluge of early adopters investing in blockchain solutions to simplify transactions, reduce costs and eliminate potential losses. The potential for adoption of Blockchain technology in India is huge and promises to do to our Financial System what the Internet has done to the Media.

Some ways in which the change can manifest are as follows-

- It can simplify transactions for government projects and make sure that every transaction and a rupee is accounted for.

- It can enable complete data protection.

- Exchange of protocols in a secure environment can lead to ease of management.

- The following blockchain applications promise to transform and simplify the following, to begin with:

- Land registration

- Agricultural produce storage

- Sale to purchase

- Manage patent and trademark

- Enabling education and food distribution, especially when it needs to be done in remote locations.

Blockchain can create trust and technology is being built to bring disintermediation. I believe that the Government–given its status and role can enable adoption of Blockchain–by doing:

- Adopting it in the distribution of agricultural produce

- Birth and death registration

- Asset registration covering land, automobile, patent, etc.

It can further enhance its confidence in the system by bringing smart flexible policies and regulations to manage KYC processes, prevent money laundering, enabling legalization of smart contracts, best practices of trust protocols, encryption protocols and cybersecurity.

So is this the brave new way of doing business? Blockchain has nothing in it that can be regarded as a threat to business. For those who embrace the new paradigm–it promises to disrupt the industry from within. All it requires is the vision to see the possibilities and the will to execute on the ground–to ensure a complete transformation in the way we do business.